Author: Berry Matijssen

Reading time: 4 min 52 sec

Last update: 10 September 2023

Index

1. Introduction to blockbuster drugs

2. Analysis setup

3. The number of blockbuster drugs per company

4. How dependent is a company on their best performing blockbuster drug

5. How much revenue does a single drug deliver

6. The average and median price of a drug

7. Conclusion on drug prices

1. Introduction to blockbuster drugs

Drug prices are a hot debate due to the rising cost of healthcare. It is a significant cost to society as the healthcare bill is growing across the world. This is not only due to the rising price of drugs as the growing and aging population also requires more care to stay healthy at an older age. To have all these products available, there are hefty investments in research and development (R&D) needed in the first place. R&D is not straightforward and there are many failed projects (although in different stages of the research process) for each successful drug launch. Once a drug is on the market it also brings in cost benefit as treatments become more effective and hence shortened or nights that are spend in the hospital reduced. In contrast, like many other products (available to consumers) drugs are subject to price maximisation which has led to differences in approval and treatment policies between countries.

A key aspect of a successful pharmaceutical company are their blockbuster drugs. These are consided as such when they generate one billion or more in revenue. The importance of these key products can be easily determined. A drug that generates 4 billion in revenue would be equal to 16 drugs that generate 250 million in revenue. It is almost impossible to invent those number of different medications and would require an unrealistic amount of capital and labour to achieve this.

2. Analysis setup

The scope of this research is limited to the pure pharmaceutical part of a company. This means that lifestyle products, diagnostic fluids and preventive medicines are excluded as they do not directly treat a disease and have a different development, marketing and practical use. Examples of these products are contraceptives, botox, fillers contrasting fluids, animal medication and vaccines. Recently, there has been a COVID pandemic which brought in much revenue for some biopharma companies. Because this is now in the past and is less likely to provide much revenue for these companies in the future, vaccines and medication that target this virus are excluded.

The data is obtained from the annual reports of 2022 of the nine largest pharma companies that focus mainly on producing and selling patented drugs. This also comes with a caveat. They publish their best performing drugs, but not all of them. This will influence the analysis, but it is not that important as the focus is on blockbuster drugs. All revenues are converted to dollar as some are reported in EUR or CHF.

3. The number of blockbuster drugs per company

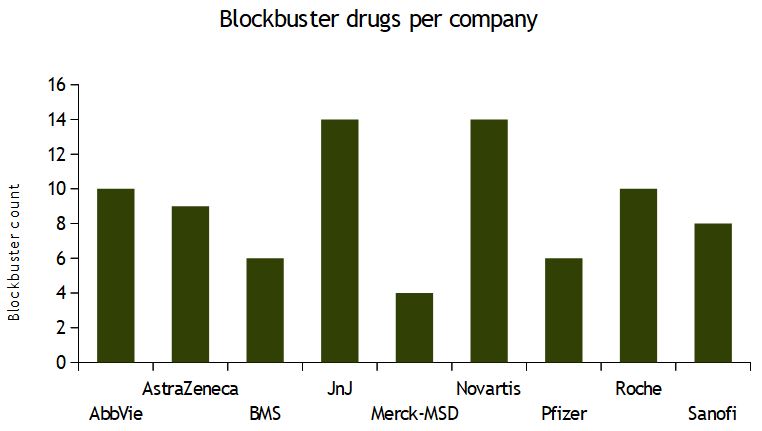

To compare the portfolio of the different pharma companies, the number of blockbusters can be determined. This shows some remarkable insights in the difference between each company. Using this count, a categorization can be made of low (six or less), medium (6-10) or high (more than 10) blockbuster drug portfolios. The low ones are Merck-MSD, BMS and Pfizer. The medium count is seen for AbbVie, AstraZeneca, Roche and Sanofi. The champions are J&J and Novartis which both offer 14 high-revenue products.

4. How dependent is a company on their best performing blockbuster drug

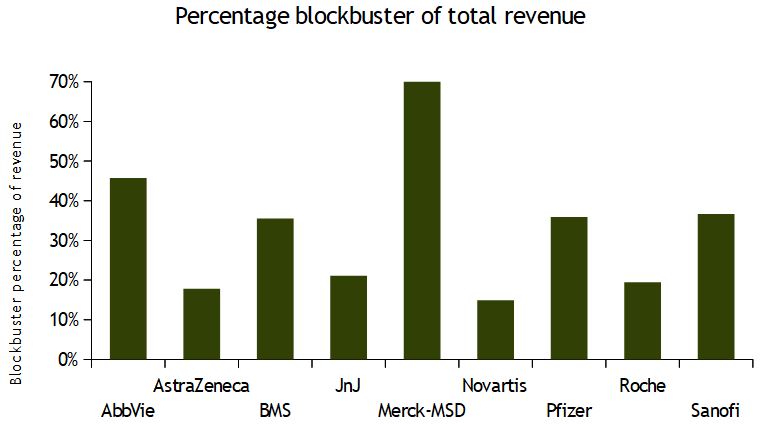

Using the total revenue of their listed products, the dependence of a company on their best performing drug can be determined. To make the companies comparable only the drugs that generate a revenue of more than 250 million are included in the drug portfolio.

Similar to the previous section, a three-way classification can be made dependent if they are lowly (less than 20%), moderate (30-50%) or highly (more than 50%) dependent on their best performing drug. Novartis has the lowest dependence on a single drug. This is in line with the previous graph that shows it has 14 blockbuster drugs in its portfolio. On the other end is Merck-MSD which for 70% of its patented drug business is dependent on a single drug.

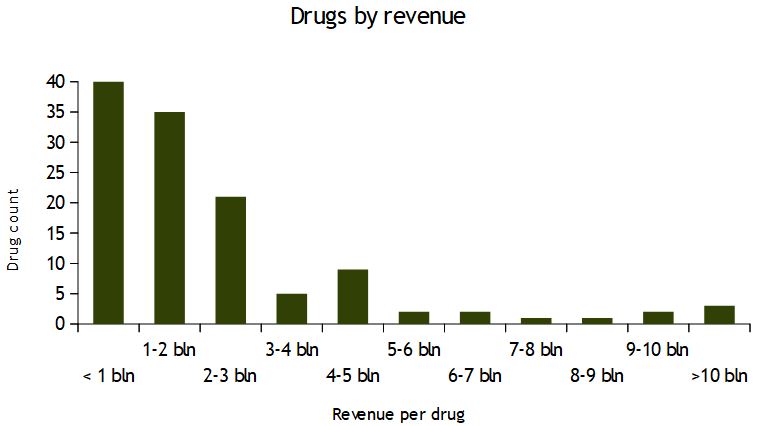

5. How much revenue does a single drug deliver

To understand how much revenue a single drug delivers, a histogram can be made in which each drug is categorized in bins of 1 billion. It is clearly visible that an optimal peak for revenue does not exist, but there are many drugs on the lower end and quickly degrades. Most drugs are below one billion in revenue. Given that only the drugs listed in the annual reports are used, it is likely that this peak is considerably higher. There is a large group in the range of one to three billion revenue. After this group, there is only a small peak in the range of 4-5 billion and a few that are over 10 billion. This clearly shows that high value drugs that generate a revenue in excess of 3 billion are rare.

The term blockbuster drug was introduced for a revenue of 1 billion dollar. This might not be true anymore as this term is a few years old and inflation has eroded this value. Drugs that generate up to two billion are more common. Therefore, it could be argued that two billion is what should be considered a blockbuster drug and are the key drivers of revenue for a pharmaceutical company.

6. The average and median price of a drug

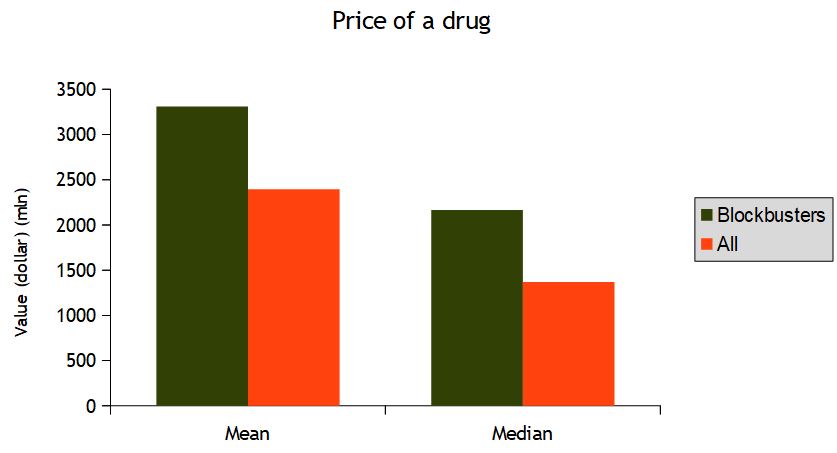

Finally, the question that started this article should be answered. To determine how much revenue a patented drug generates the mean and median revenue for a single drug can be determined. The mean is 3.3 billion dollar for blockbuster drugs and 2.4 billion for all reported drugs. However, this is highly influenced by a few very high-revenue generating drugs. The median is, therefore, a better indication for a patented drug which shows a revenue of 2.1 billion for blockbusters and 1.4 billion for all reported drugs.

The confusion is that the value of 1 billion is representative of an average patented drug. A blockbuster is supposed to be a high performer which a value of 1 billion does not indicated. The median value of 2 billion is a likely to be a better representation of performing above average.

7. Conclusion on drug prices

In this article, the drug portfolio of a pharma company was examined. The size of the drug portfolio of a pharmaceutical company is usually modest and most of the revenue is driven by six to fourteen blockbuster drugs. The dependency on the best-selling drug varies considerably from 15% to 35% for most companies. Some exceptions with 45% and 70% exist. The price of a drug does not show an ‘optimal’ price. Most drugs start moderate and with price increase the number of drugs decrease. This confirms the dependence of a large part of revenue by a single or a few drugs.

In reality there is no typical price of a patented drug as there is no ‘peak’ in the distribution of prices. But if it needs to be determined, the median value of 2 billion would be best suited. It is probably better to define the 2 billion as the revenue that a patented drug should deliver to be a key driver of the pharmaceutical portfolio. Hence, it can be argued that the term blockbuster drug should be upgraded from 1 billion to 2 billion dollar in annual revenue.

It is clear that pharmaceutical companies rely heavily on a small amount of blockbuster drugs to drive their revenue and there is a limited amount of them on the market. Across these nine companies there are only 46 drugs that actually bring in the 2 billion in revenue or more. This averages to five blockbusters per company.