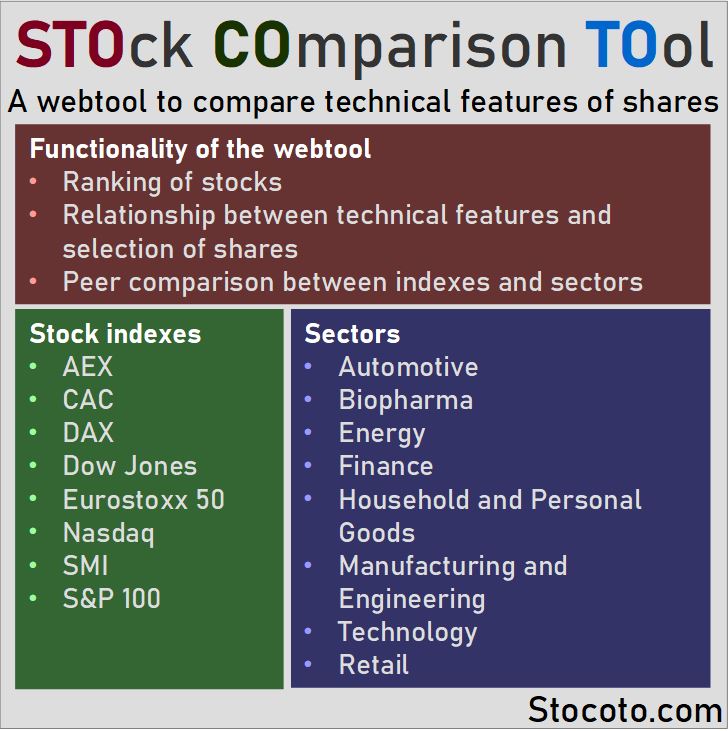

The STOck COmparison TOol is designed to compare stocks using performance and technical features for eight indexes (S&P, CAC, DAX, NASDAQ, etc.) and eight sectors (finance, technology, energy, biopharma, etc.). The visualization of the comparison provides insights into market performance, identifies potential trading opportunities, determines risk and performs a peer comparison. For a selection of companies, a deep-dive into price and volume over time is available in the shape of a technical analysis (MFI, MACD, AD, Stochastic Oscillator). All features are visualized using interactive histograms and charts with (where possible) reference lines provided. The StoCoTo platform offers a unique way of viewing stock market data that allows the trader to pre-select shares that can be considered opportunities and provide an understanding of risk. Types of trading strategies that this tool is suitable for (but not limited to) are momentum, technical and swing trading.

Last data refresh: 10 May 2024 – 11:54 C.E.T. (Amsterdam)

New blog! The Netherlands Will Win the Eurovision 2024 Based on Data Analysis Using YouTube and Spotify Performance

The popularity on the website of Eurovision and media streaming site can be used to rank the different participants. Based on who does well in all rankings, predicts who will be the winner. Read why The Netherlands will win, followed by Italy and Croatia.

Previous articles were on finding the best fragrance, partner availability by age, cost of manufacturing a car or a different look at blockbuster drugs.

Compare stocks with technical features

Comparing stocks is a challenging task, but can be achieved using the standard metrics price change and trade volume over time. From these two, a range of features such as technical indicators (volatility, money flow, short/medium price performance, MFI, RSI) can be derived. This webtool allows the comparison of the stocks in different indexes and sectors using easy-to-interpret graphs and histograms.

Analysis of shares provided by the webtool

A set of analysis is available for each index or sector. The structure is the same for all. The pages for the individual companies have a different structure focussing only on technical analysis. The link for each section provides an explainer handout.

- Data overview – A table that contains the most important values that are used in the analysis of each stock.

- Index/sector performance overview – A ranking of traded companies to understand which have shown the best price growth, trade activity, volatility or money flow.

- Performance insights – An overview of the recent price changes an trade activity (volume) to understand how a selected stock is performing and providing a reference by comparing it to other companies in the same index or sector.

- Trading opportunities – Four comparison of stocks based on technical indicators and price movement to identify opportunities to pre-select stocks that are a buy or sell.

- Understanding risk – An understanding of the current price in relationship to recent price movement and its high/low of the previous year.

- Peer comparison – How does an index or sector perform compared to all other stocks. A potential first step before focussing on individual shares.

- Technical analysis – Graphs that show technical indicators such as MFI, MACD, Stochastic Oscillator, etc over time for individual listed companies.

Analyse the leading stock markets of Europe and USA

Currently, there are eight stock markets available for comparison and analysis. They represent the majority of the largest and most traded listed companies in North America and Europe. The selected indexes are:

- AEX (Netherlands)

- CAC (France)

- DAX (Germany)

- Dow Jones (USA)

- Eurostoxx 50 (Eurozone)

- NASDAQ (USA)

- SMI (Switzerland)

- S&P 100 (USA)

In addition, a selection of companies has been made from each stock market based on their trade activity and relevance. These are grouped in the ‘StoCoTo selection’ and will for most traders represent the main stocks of interest. All of the companies in this selection have an individual technical analysis available.

Focus on comparable companies by choosing any of the eight sectors

There are eight company sectors available on the analysis platform. Many alternative sectors contain few stocks making their analysis irrelevant. Therefore, only the ones are included when enough companies are available that a reliable comparative analysis can be performed. The available sectors are:

- Automotive

- Biopharma

- Energy

- Finance

- Household and Personal Goods

- Manufacturing and Engineering

- Retail

- Technology

A range of technical indicators are available to analyze shares

Across the different individual stock analysis a set of performance and technical indicators are available that are derived from price and volume. Together these make up a profile of an individual share. A carefull selection has been made to avoid duplication of indicators that only differ moderately. The available technical indicators (with a link to their description) are:

- Share price

- Trade volume

- Trade value

- Volatility

- Relative strength index (RSI)

- Money flow index (MFI)

- Moving average convergence divergence (MACD)

- On Balance Volume (OBV)

- Accumulation/distribution (A/D)

- Stochastic Oscillator

- Commodity channel index (CCI)

Tip 18: Understand technical indicators from the current perspective

In hindsight, it is easier to understand the change in price in relation to a technical indicator of overbought or oversold conditions. However, it is more difficult to apply the correct knowledge in the current situation because its future price behaviour is unknown. In other words, explaining the past is easier than making a correct forecast. Therefore, when interpreting recent trading signals, ignore (partly) the price change that comes afterward to get a better understanding of their intended application and usability.

All tips & tricks have been collected in a dedicated page. Spend a few minutes here to make the most out of the Stock Comparison Tool.

Update: 3 May 2024 -The indexes have been updated to show the correct listed companies as there were some changes in recent time.

Update: 22 March 2024 – Some of the technical articles under the guides section were in need of some updating. Changes have been made to complete the text and improve readability.

Update: 23 February 2024 – In the last two weeks all XY-graphs on the index and sector pages received an update. Titles have been clarified, reference lines added and readability improved.

Update: 16 February 2024 – The last explainer has been added to complete the index/sector comparison pages. This one describes the performance insights section that consists of three XY-graphs.

Update: 2 February 2024 – The next handout has been added. This time for the data overview table.