A leading indicator linking volume to stock price movement

Author: Berry Matijssen

Reading time: 4m:57s

Updated: 21 June 2024

Content

- On-Balance Volume in a nutshell

- Key points

- OBV calculation and formula

- Insights provided by on-balance volume

- Limitations

- Practical example

- The difference between OBV and Accumulation/Distribution indicator

- Use of OBV on StoCoTo.com

- A word of caution

- Other relevant articles on StoCoTo

1. On-Balance Volume in a nutshell

On-balance volume (OBV) is a technical momentum indicator that uses the flow of trade volume to predict changes in stock price. The underlying principle behind OBV is that volume is the main force that drives a price change. The key assumption is that an increase in trade-volume without a significant change in the stock price is likely to lead to an increase or decrease of the share price. This principle makes it a leading indicator.

2. Key points

- On-balance volume (OBV) is a leading technical indicator of momentum, based on trade volume changes as a signal for upcoming for price changes.

- The value of OBV is cumulative and has no range or references. The result is that its value has no direct interpretation. Its importance is the trend it follows compared to the share price.

- The main principle is that higher volume will lead to a change in share price. This can be visualized as a divergence between the lines of the stock price and OBV over time.

- The goal of OBV is to establish a volume trend in combination with a price trend, and a divergence between both acts as a signal.

- If OBV remains flat, but price increases, it could be that the price reverses as the price increase is not driven by traded volume.

- If OBV increases or decreases, but the price remains flat, the indication provided by OBV is that share price will eventually increase or decrease.

3. OBV calculation and formula

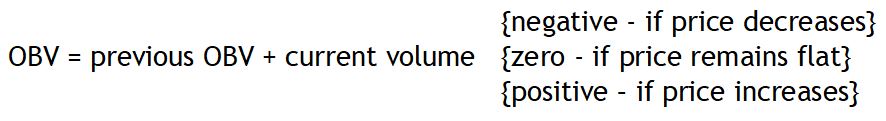

On-balance volume is a running total of and the trading volume of a share. It indicates if the volume is flowing in or out of a given stock. The OBV is a cumulative total of volume (at day close) that is defined as positive or negative. There are three rules implemented in the calculation of OBV. They are:

- If the current closing price is higher than the closing price of yesterday, then:

Current OBV = previous OBV + volume today

- If the current closing price is lower than the closing price of yesterday then:

Current OBV = previous OBV – today’s volume

- If the current closing price is equal than the closing price of yesterday then:

Current OBV = previous OBV

4. Insights provided by on-balance volume

The theory behind OBV is based on the relationship between traded volume and share price. If stock trade volume increases, than price should respond. This can be driven by a sell-off in which the share price would drop, or higher demand which would result in a price increase. When the price does not change while trade volume is higher than before, the assumption is that a price change will occur, but with a delay. The goal of OBV is to establish a volume trend in combination with a price trend, and a divergence between both acts as a trading signal.

The actual value of OBV is not relevant as it is a sum of numbers and does not have a direct-interpretable scale or oscillates between two values. The indicator itself is cumulative, while the time interval remains fixed by a dedicated starting point. This means that the start value of OBV depends on the initial date. As not the whole sequence of trading is used from the start or only a part of it (such as one year), a change of number can occur when a different start date is selected. The trend does not change and therefore, a trader should analyse the extend of OBV movements over time. The slope of the OBV line carries all the weight of analysis. Share price and OBV normally move as a pair, and a trader can treat divergences (upward and downward) between both as a sign of an upcoming price change.

If the OBV line remains flat, but the stock price increases, it could be that the price reverses as the price increase is not driven by traded volume. In contrast, if OBV increases or decreases, but the price remains flat, the indication provided by OBV is that share price will eventually increase or decrease.

5. Limitations

A limitation of OBV is that it cannot be used for predicting stock price, but provides only an indication of a possible price change to occur. The ability to provide this signal makes it a leading indicator. Unfortunately, it is prone to produce false signals, which is common with many technical trading indicators used by investors.

Another limitation is that a large spike in volume on a single day can influence the OBV indicator for a longer time. For example, an unexpected earnings announcement can cause an increase in buying or selling behaviour resulting in a peak in volume and change the OBV significantly. Because the OBV trendline suddenly changes it is not valid any more and, a new trend starts. It takes time to observe how OBV aligns with price in this new trend and care should be taken when interpreting a newly formed divergence signal.

6. Practical example

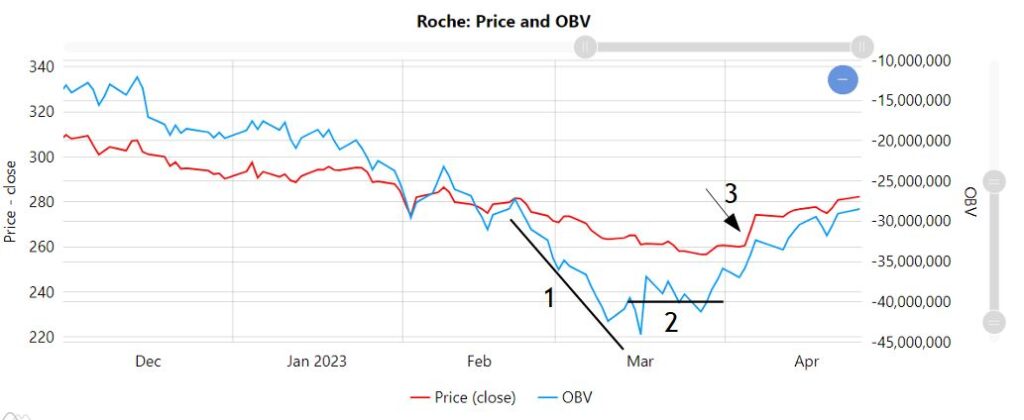

An example of OBV in can be seen by observing the behaviour of the share of Roche and its changes in trends in relation to the price using a chart in which both values are plotted over time. In general, there is a trend in which the share price declines while the OBV declines as well. But around February a change in trends occur. This can be described in three parts:

- The decline of OBV accelerates, indicating a price change.

- The price change does not occur and the OBV flattens while the price drops further.

- A turnaround occurs and price increases again and OBV increases with it.

Because price and OBV do not operate on the same scale, it can be difficult to compare the trend. In this example, a larger period of price decreases combined with and decreasing OBV cannot be exactly overlayed. However, the change in pattern is visible. The occurrence of a change in trend in the relation between OBV and price shows the value of a price change that is about to happen.

7. The difference between OBV and Accumulation/Distribution indicator

On-balance volume and the accumulation/distribution (AD) line are both momentum indicators and are similar in that they make use of volume to predict the price movement to identify trading opportunities. Both indicators also use the previous value and correct it based on today’s trading activity. The difference is in that the OBV, the signal is calculated by summing the volume on an up-day and subtracting the volume on a down-day while the AD indicator applies a correction factor based on price to correct the trade volume before adding to the previous trading result. In short, this makes the A/D indicator price weighted, while the OBV is not. This provides the opportunity to use both indicators in a trading strategy as they generate a different signal and, therefore, could lead to a different investment decision.

8. Using OBV on StoCoTo.com

The StoCoTo platform employs the On-Balance Volume (OBV) in the deep-dive of the individual company stock pages, in which the OBV is plotted against the share price over a minimal time period of one year. This allows the trader to compare historical price changes in relation to the OBV signal and observe where similarities and deviations occur. In combination with other charts such as RSI and MFI, it is possible to compare the behaviour of these technical indicators to the stock price and establish which could have more relevance. Lastly, to understand OBV better, it is recommended to study different price change patterns of different stocks, but during the same time period to better understand its behaviour and make a better informed decision.

9. A word of caution

Technical indicators have been around for many years and this prolonged existence make a good cause for using them. But it should be noted that On-Balance volume is a historical parameter and does not directly predict the future but can be used as an indicator. Furthermore, On-Balance volume measures trading activity and does not directly indicate the direction in which a stock moves. Therefore, relying on one indicator is not good practice and a better approach would be to combine it with other sources of information such as news items, quarterly results and fundamentals to analyse a stock and assess its associated risks. In addition, developing a trading strategy that includes technical indicators and reviewing the performance and learnings of this strategy is more likely to lead to good results than relying on a single indicator.

10. Other relevant articles on StoCoTo

Read more about On Balance Volume in The Big Manual

Other cumulative indicators are: A/D indicator and volatility

Other technical indicators that include volume are: A/D indicator and MFI

#obv #onbalancevolume #tradingvolume #technicalanalysis #technicalindicators #tradingsignals #stocktrading