A lagging/leading momentum indicator linking the closing price to price behaviour to identify trading opportunities,

Author: Berry Matijssen

Reading time: 5m:41s

Updated: 25 October 2024

Content

- The Stochastic Oscillator indicator in a nutshell

- Key points

- Stochastic Oscillator calculation and formula

- Insights provided by the Stochastic Oscillator

- Limitations

- Practical example

- The difference between the Stochastic Oscillator and the Relative Strength Index

- Using Stochastic Oscillator on stocoto.com

- A word of caution

- Other relevant articles on StoCoTo

1. The Stochastic Oscillator in a nutshell

The stochastic oscillator is a momentum indicator that compares the current closing price of a share to its price range over the 14 previous trading days. The theory underlying this indicator is that in an upward price trend, the closing price will be near the high, and in a market that moves downward, the closing price will be close to the low. This indicator attempts to quantify this behavior and is used to generate trading signals that indicate overbought and oversold signals. It behaves as an oscillator and operates within a range between 0 and 100. Reference values of 20 (oversold) and 80 (overbought) can used by the trader to indicate a trading signal (sell or buy) for an asset as a potential price change (e.g. swing) is expected.

2. Key points

- A stochastic oscillator is a momentum indicator for generating overbought and oversold signals.

- The underlying theory suggests that when a stock is trending upwards, the closing price will be near the high, and in a market that is trending downwards, the closing price is near the low.

- The calculation focusses on comparing the most recent closing price to the lowest and higest closing prices of the previous 14 days.

- Stochastic oscillators tend to vary around a mean price level because they are based on the price change of the last 14 trading days.

- There are two oscillators calculated. The Kfast is the actual calculation for each trading day and the Kslow is derived from three Kfast values and is intended to identify stronger trends and act as a smoothing function.

- Stochastic oscillators work on a scale of 0 to 100. A signal value above 80 suggests a share is overbought, while a value below 20 indicates it is oversold.

3. Stochastic Oscillator calculation and formula

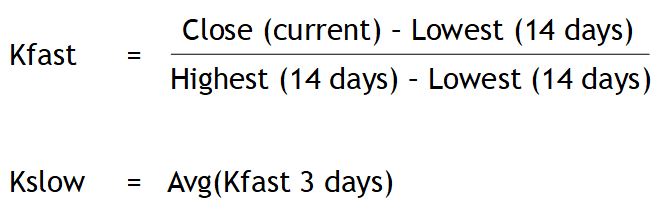

The Stochastic Oscillator is calculated and visualized as the Kfast (%K) and the Kslow (%D). The Kfast is the current price represented as a percentage of the difference between its highest and lowest values over the last 14 trading days. In essence, the Kfast represents the current price in relation to the recent price change of the share.

The Kslow represents the 3-most-recent-trading-days average of the Kfast. The main feature setting the Kslow apart is using a longer time-period that is compared to the 14 trading days. This line is used to show the longer-term trend for the current price and indicates if the current price trend is continuing for a longer period. In addition, it also acts as a smoothing function. A longer period of more than three trading days to calculate the Kslow would result in a smoother line, but it takes longer before a trading signal is obtained and as a consequence, a trading opportunity could be missed.

The standard reference time used in the calculation is 14 trading days. This can be adjusted if a different requirement or purpose exists. The stochastic oscillator is calculated by subtracting the low for the period from the current closing price, dividing by the total range for the period, and multiplying by 100.

The steps for calculating the Stochastic Oscillator are:

- Calculate the Kfast (see formula) using the close of the current trading day and the lowest and highest of the last 14 trading days.

- Determine the Kslow (see formula) by taking the average of the Kfast of the last 3 trading days.

4. Insights provided by the Stochastic Oscillator

The stochastic oscillator falls within a range between 0 and 100. This makes it an indicator that suggests signals for overbought or oversold conditions as reference values (like other oscillating functions) are available. In general, a value above 80 is considered overbought, while under 20 is considered oversold. These do not always correlate directly with an upcoming price trend reversal, but could be better interpreted as having a high chance of price reversal. Strong trends can maintain overbought or oversold conditions for a longer period of time. Furthermore, a breakthrough can occur in which the trend is continued for a longer time until a new normal is obtained.

The visualization of the stochastic oscillator in a line graph consists of two lines. One reflecting the actual value of the oscillator for each session (Kfast or %/D), and one reflecting its three-day simple moving average (Kslow or %D). Because price is believed to follow momentum, the intersection of these two lines is considered a signal that a reversal may happen.

In a line chart, a divergence between the stochastic oscillator and the price trend is often interpreted as a reversal signal. For example, when a downward trend reaches a new lowest price, but the oscillator shows a higher low, this could be indicative that the downward trend is coming to an end and a price reversal going upwards could happen.

5. Limitations

The main limitation of the stochastic oscillator (like other technical indicators) is that it is known to produce false signals. This happens when the indicator suggests a trading signal, but the price trend does not change direction. The stochastic oscillator can for some stocks indicate more trading signals than other indicators. This means that during volatile periods many trade signals are observed, but few of them should be acted upon. This makes the StochOsc different from other technical indicators and complements a complete technical analysis that works as one of their tools for an investor.

6. Practical example

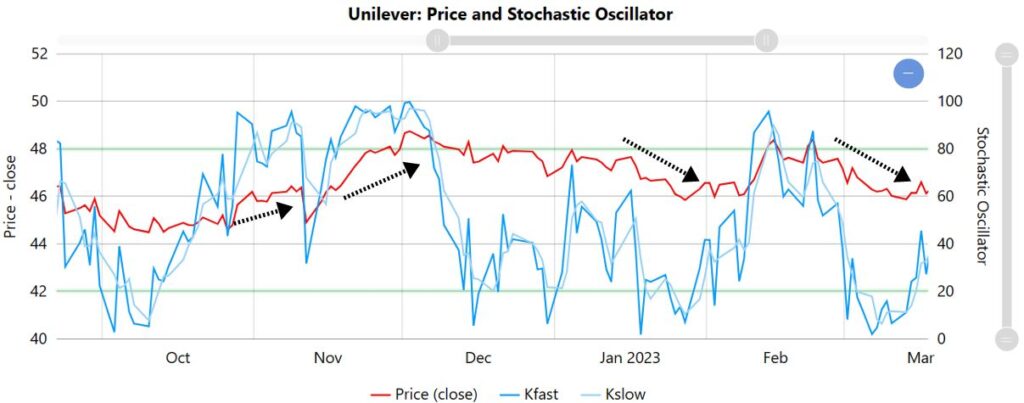

An example of the stochastic oscillator in practice can be shown when correlating this feature with the price changes for Unilever. For the selected period there are several upswings and downward trends observed. The ones described are highlighted by the black arrows.

The two upswings coincide with readings of the stochastic oscillator above 80. The time between those two peaks shows a drop in the value but does not fall below 20. When the price increases, the value reaches above 80 again.

The two trends in which the value is below 20 show a drop in share price. The second downtrend could be considered stronger as the signal stays longer below 20. As soon as the price stabilizes, the value will be above 20.

Apart from those four trends, there are several other moments where the values are above 80 or below 20. This indicates a trade signal, but the share price does not always change its trade value. Furthermore, these periods in which they stay above or under the thresholds are short, which confirms their limitations as a trade signal. The challenging part is how to deal with waiting for a strong trade signal to confirm and act upon it If a traders waits too long, there is a chance that the opportunity will be missed or have been passed.

7. The difference between Stochastic Oscillator and the Relative Strength Index

The relative strength index (RSI) and stochastic oscillator are both momentum oscillators based on price. The stochastic oscillator is based on the assumption that closing prices should be in the same direction as the current trend. In contrast, RSI identifies overbought and oversold levels by measuring the speed of price movements.

These differences are reflected in the calculation of both values. The Stochastic Oscillator uses the current closing price and the low and high of the last 14 trading days. The RSI calculates the total gain and loss over the last 10 trading days. Therefore, both are fundamentally different. An additional trading insight could be obtained by comparing the values of the two indicators over time and attempting to explain why they are different.

8. Using Stochastic oscillator on stocoto.com

The StoCoTo platform makes use of the stochastic oscillator in the deep-dive technical analysis of individual stocks. Because its value fluctuates significantly and provide many trade (false) value comparing stocks based on this value is not the best approach. Hence, it is not included in the index and sector stock comparisons.

On the individual company stock pages, the stochastic oscillator plotted against the share price over a time period of at least one year. The reference lines at the value of 20 and 80 are added to provide guidance. This allows the trader to observe historical price changes in relation to the trade signals provided by stochastic oscillator and provide some guidance if the added thresholds have value. As all graphs cover the same timeframes, it is possible to check the behaviour of other technical indicators around the same time point.

9. A word of caution

Technical indicators have been around for many years and their prolonged existence makes a valid case for their use. It should be noted that the Stochastic Oscillator is a historical parameter and does not accurately predict the future. The Stochastic Oscillator calculates trading activity and does not directly indicate the direction in which a stock moves. Therefore, relying on one indicator is not a good practice and a better approach could be to combine it with multiple indicator and other sources of information such as news resources, credit ratings, quarterly reports, etc. to analyze a stock and understand its associated risks. In addition, developing a trading strategy that includes technical indicators and reviewing the performance and learnings of this strategy has a better chance of leading to good results than relying only on a single indicator.

10. Other relevant articles on StoCoTo

Read more about the Stochastic Oscillator in The Big Manual

Other oscillating indicators are: CCI, MACD, MFI and RSI

Other technical indicators based only on price are: CCI, MACD and RSI

#stochasticoscillator #stochosctrading #oversold #overbought #technicalanalysis #technicalindicators #tradingsignals #stochosc #momentumindicator #stochasticoscillatorcalcluation